In a big step towards improving climate action, the Integrity Council for the Voluntary Carbon Market (ICVCM) has revealed the initial carbon crediting programs eligible for its prestigious Core Carbon Principles label. This announcement marks an important moment for the voluntary carbon market, showing a strong effort to maintain honesty and openness in carbon offsetting initiatives.

The voluntary carbon market has great potential as a way to channel investments into projects that aim to reduce greenhouse gas emissions and promote sustainable development worldwide. These projects, ranging from community-driven efforts providing clean cookstoves to large-scale initiatives protecting important forest ecosystems, play a major role in fighting climate change and supporting local livelihoods.

Recognizing the important role of the voluntary carbon market, major corporations like Bain and Co and Microsoft have already gotten involved in this area to fulfill their climate commitments. However, concerns about the quality and reliability of carbon credits have been increasingly examined in recent years, requiring strong regulatory measures to ensure market integrity.

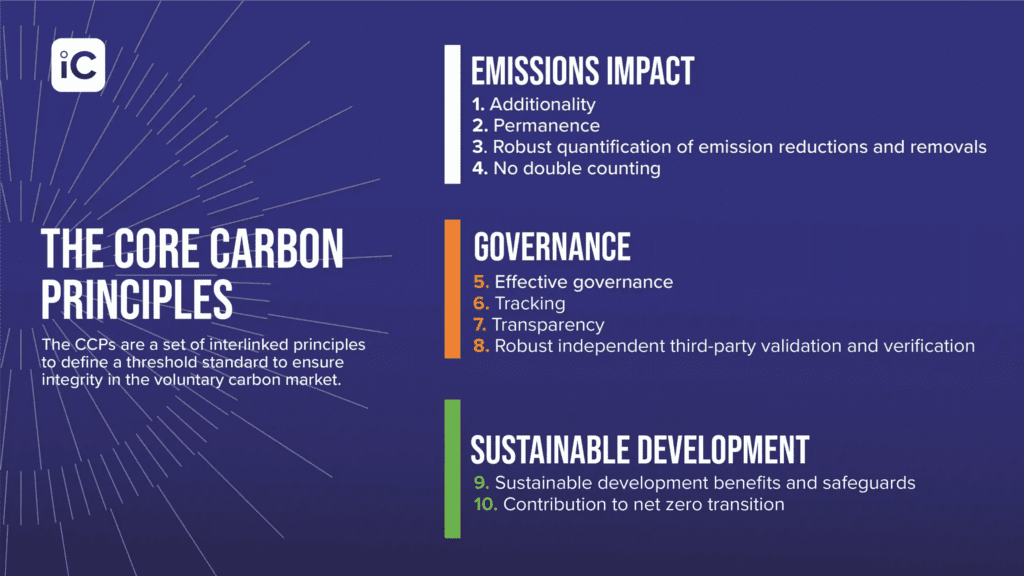

The Integrity Council for the Voluntary Carbon Market introduced Ten Core Carbon Principles in July 2023, as well as a detailed Assessment Framework, serving as a symbol of quality assurance within the carbon crediting landscape. By assessing carbon crediting programs against these principles, the council aims to differentiate high-quality credits from lower-quality ones, thus building trust and confidence among market participants.

Among the pioneering companies meeting the strict criteria set by the Core Carbon Principles is Gold Standard, a well-known player in the carbon offsetting space. Gold Standard’s eligibility for the Core Carbon Principles highlights its strong commitment to measuring impact, ensuring governance transparency, and upholding independent verification processes in its carbon crediting operations.

Margaret Kim, CEO of Gold Standard, expressed delight at the recognition, emphasizing the organization’s dedication to environmental integrity and sustainable development. Kim noted, “The CCPs represent an important step on this journey. As a pioneer of sustainable development inclusion in carbon markets, we will continue to demonstrate integrity and innovate to deliver a just transition towards global net zero.”

The Core Carbon Principles label not only indicates Gold Standard’s leadership in adhering to high-integrity criteria, but also enhances buyer confidence in the carbon market. Looking ahead, Gold Standard expects further collaboration with ICVCM to thoroughly assess its credits, thereby ensuring transparency and accountability in its impact registry.

The announcement of the first companies eligible for the Core Carbon Principles label signals a new era for the voluntary carbon market. With the assurance of integrity and credibility, these companies are set to drive meaningful climate action and sustainable development on a global scale. As the Integrity Council continues its assessment process, we can expect further progress towards realizing the full potential of the voluntary carbon market in addressing the climate crisis.

In conclusion, the journey towards a sustainable future requires not only ambitious targets but also unwavering integrity and transparency, principles that are at the core of the Core Carbon Principles initiative. As more companies embrace these principles, the voluntary carbon market gets closer to becoming a powerful force for positive change in the fight against climate change.