2023 Non-Financial Report: more advancement on sustainability

- Management Board compensation connected to decarbonization targets

- Net-zero goals for seven carbon-heavy sectors, encompassing 54% of funded emissions of the corporate loan book

- In-house (Scope 1 and 2) carbon emissions reduced by 71% since 2019, with 97% of electricity from renewable sources

- Sustainable finance and ESG investment volumes increase by € 64 billion to € 279 billion cumulatively since the beginning of 2022

- Gender diversity: 46% of all staff, 32% of senior roles and 40% of Supervisory Board positions held by women

- Controls: around 500 additional Anti-Financial Crime specialists in 2023

- € 52.6 million invested into Corporate Social Responsibility projects by Deutsche Bank and its foundations, reaching 1.7 million people in 2023

“In 2023 we showed the strength of our Global Hausbank and its value for clients,” said Christian Sewing, Chief Executive Officer. “Business growth, combined with cost and risk discipline, enabled us to drive substantial increases in capital distributions to shareholders while making key investments in revenue generation, technology and controls. These investments have started to pay off, and this gives us great confidence that we will deliver on our 2025 targets.” He added: “We also made significant progress toward our goals of building a more sustainable Deutsche Bank and creating a diverse, inclusive work environment for all our talents.”

Sustainability: significant progress in 2023

Management Board compensation linked to decarbonization targets: for the first time, Deutsche Bank ties part of the compensation of the Management Board to the decarbonization of its corporate loan portfolio. This is reflected in the ESG component of the Long-Term Incentive for Management Board members from 2024 onwards. The environmental aspect depends solely on achieving reduction targets for reducing funded emissions in specific carbon-heavy sectors on the bank’s pathway to net zero. This measure goes beyond the carbon-related targets which formed part of Management Board compensation-setting in recent years.

Net-zero goals for seven carbon-heavy sectors: in October 2023, as part of its Initial Transition Plan, Deutsche Bank expanded the scope of its decarbonization plans by publishing net-zero goals for its corporate loan book in three additional industry sectors: coal mining (both thermal and metallurgical), cement and shipping. As a result, seven carbon-heavy sectors, representing 54% of the total funded emissions of the corporate loan book (scope 1 and 2 of the corporate clients), are now covered by net-zero goals by 2030 (interim) and 2050 (final). Together with the publication of Deutsche Bank’s white paper on European Residential Real Estate in May 2023, 60% of the bank’s total loan book is covered by funded emissions disclosures. Deutsche Bank plans to continue this progress in 2024 with the publication of net-zero goals for at least two further industry sectors.

Deutsche Bank has reported progress on reducing emissions in sectors covered by net-zero targets during 2023.

- In the Oil & Gas (upstream) sector, the financed emissions were 18.5 million tons of CO per year (MtCO/y) at year-end 2023, which is an 11% year-on-year increase but a 21% decrease from the 2021 baseline of 23.4 MtCO2/y. The increase in 2023 was due to client portfolio effects and FX movements, with a strengthening US dollar increasing loan exposure reported in euros, partly offset by lower client emission factors due to rising Enterprise Values Including Cash (EVICs) in 2022

- For power generation, the bank's portfolio saw a 3.9% year-on-year decrease in Scope 1 emission intensity to 371 kilograms of CO equivalent per megawatt hour (kgCOe/MWh), down from the 2021 baseline of 396 kgCOe/MWh, reflecting improvements in the physical emission intensity of the portfolio

- In the Automotive (light duty vehicles) sector, the Scope 3 physical emission intensity decreased by 15% year on year to 159 grams of CO per vehicle kilometer (gCO/vkm), down from the 2021 baseline of 190 gCO/vkm, reflecting lower emission intensity driven by decarbonization efforts of clients

- In the Steel sector, the Scope 1 and 2 physical emission intensity decreased by 7.5% year on year to 1,384 kilograms of CO equivalent per ton (kgCOe/t), down from the 2021 baseline of 1,519 kgCOe/t, reflecting data quality improvements for selected client assets

- For Coal Mining, the financed emissions decreased by 23% year on year to 6.1 million tons of CO per year (MtCO/y), with a nearly equal division between thermal and metallurgical coal, down from the 2022 baseline of 7.9 MtCO/y. This decrease partly reflected selected client exits, client portfolio effects, and a decline in client emission factors due to rising EVICs in 2022, offset by the aforementioned FX movements

- Cement saw a slight increase in the Scope 1 and 2 physical emission intensity to 764 kilograms of CO equivalent per ton (kgCOe/t), compared to the 2022 baseline of 731 kgCOe/t, reflecting volatility in a small portfolio with total loan commitments of € 0.3 billion

- In Shipping, Deutsche Bank’s Poseidon Principles Portfolio Climate Alignment Scores, of 14.1% (Minimum trajectory) and 18.3% (Striving trajectory), were both favorable compared to the industry average, according to the Revised Strategy of the UN’s International Maritime Organisation for 2022 (Source: Poseidon Principles). Deutsche Bank plans to publish its 2023 scores with its 2024 reporting according to the Poseidon Principles methodology

Deutsche Bank has reduced emissions from its own operations (scope 1 and 2) by 71% since 2019. The bank also raised its target for reducing total energy consumption by 2025 to 30% below 2019 levels, up from 20%. The share of Deutsche Bank’s electricity sourced from renewables reached 97% in 2023 and the bank is on track to reach 100% by 2025. Supply chain emissions were 1,286,521 metric tons of CO equivalent in 2023, up 3.8%, over 2022, partly reflecting a higher number of employees. Deutsche Bank tightened sustainability criteria for suppliers in 2023 and set a 2030 interim target for a 46% reduction in emissions from its own operations and supply chain versus 2019.

The amount of money in sustainable finance and ESG investments rose to €279 billion in 2023, with financing volumes growing by 35% to €119 billion, capital market issuance volumes rising by 27% to €114 billion, and assets under management growing by 24% to €46 billion. Additionally, DWS’s ESG assets under management increased to €133 billion in 2023.

In 2023, Deutsche Bank expanded its sustainability efforts by establishing a Nature Advisory Panel to assess nature-related risks and joining #BackBlue, a UN-backed initiative to support ocean protection.

Deutsche Bank continued to invest in Anti-Financial Crime (AFC) capabilities in 2023, with the number of dedicated AFC specialists rising to 2,431 and delivering enhancements in risk assessment, Know-Your-Client (KYC) controls, and transaction controls.

Ongoing investments in talent and diversity for employees.

Deutsche Bank saw improvements in its 2023 People Survey, with the Employee Commitment Index rising to 70% and the Employee Feedback Culture Index improving to 74%.

In 2023, women made up 46.3% of Deutsche Bank’s total workforce, with advancements in gender diversity in senior roles and talent development programs.

- The representation of women in Management Director, Director and Vice President roles increased to 32.3% in 2023, and women accounted for 42% of the bank’s Director Acceleration Programme and 49% of the Vice President Acceleration Programme.

- 40% of Supervisory Board members at Deutsche Bank were women in 2023.

- Deutsche Bank hired 1,177 graduates and 547 vocational trainees in 2023, exceeding the numbers from the previous year. The bank also increased training hours and expenses.

Continued support for communities via Corporate Social Responsibility.

Through 2023, Deutsche Bank invested €52.6 million into social commitments, reaching 3.9 million people through its Corporate Social Responsibility (CSR) and Art, Culture and Sport programmes.

Deutsche Bank's program for engaging young people included 138 education projects in 34 countries. The aim was to raise ambitions, develop skills, and improve access to education and job opportunities for young people. The bank promised € 1 million for initiatives to educate young people about countering antisemitism and other forms of racial and ethnic discrimination.

- Deutsche Bank and its employees support over 10 projects worldwide aimed at improving financial literacy and inclusion. Since 2021, these projects have reached more than 65,000 young people. In 2023, over 100 Deutsche Bank employees shared financial knowledge with more than 6,000 young people during a four-week school tour across Germany.

- In 2023, Deutsche Bank supported 141 community projects in 29 countries, providing basic welfare, supporting homeless people, promoting affordable housing, and offering emergency relief and disaster recovery in crises, aiming to build strong and inclusive communities.

- Deutsche Bank's environmental impact program, in 2023, supported 47 projects in 20 countries focused on protecting and restoring oceans, coastlines, rivers, wetlands, forests, farmland, and urban green spaces, as well as raising awareness through education.

- Deutsche Bank's enterprise program offers guidance, support, and improved access to networks and funding for social and creative enterprises in eight countries.

- In 2023, more than 23,400 of Deutsche Bank's employees, which is 27% of the total workforce, volunteered for social initiatives. This is an increase from 22% in 2022. Employees dedicated over 212,000 hours to volunteering in 2023, up from around 187,000 hours in 2022.

Other financial and regulatory reports

Today Deutsche Bank published its 2023 Pillar 3 Report and Annual Financial Statements of Deutsche Bank AG under German accounting rules (HGB). Additionally, the Annual Report on Form-20-F 2023 will be available.

For a description of this and other non-GAAP financial measures, see 'Use of non-GAAP financial measures' on pp 15-24 of the fourth quarter 2023 Financial Data Supplement

²Cumulative ESG volumes include sustainable financing (flow) and investments (stock) in the Corporate Bank, Investment Bank, and Private Bank from January 1, 2020, to present, as outlined in Deutsche Bank's Sustainability Deep Dive of May 20, 2021. Products encompass capital market issuance (bookrunner share only), sustainable financing, and period-end assets under management. Cumulative volumes and targets do not include ESG assets under management within DWS, which are reported separately by DWS.

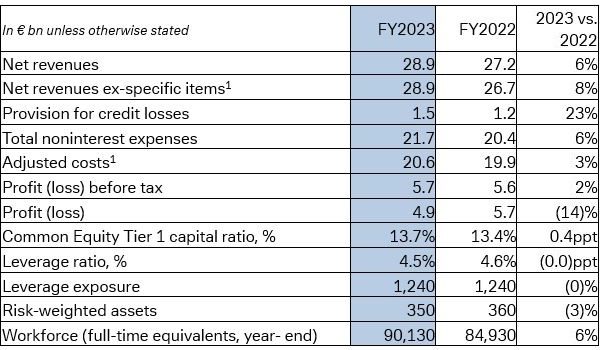

Final and audited results at a glance

View Full Report Here